Opportun offers personal loans for all types of profiles and purposes or loans, an application without excessive bureaucracy, secure and fast financing process. Their loan amounts range from $300 to $10,000, and you can use the amount you get for whatever purpose you want. From rent to medical expenses and more.

OPORTUN PERSONAL

ZERO FRAUD LIABILITY Affordable paymentsPlus, it takes every credit score into account during the application process and provides fast prequalification without compromising your credit score. Affordable loans with fast financing. Read this article to find out if Oportun has the right loan for you.

Other details

Oportun Personal Loans do not have more than 35.99% APR. Applicable terms and fees vary depending on your state of residence and other factors.

Some loan amounts are currently unavailable in certain states. For example, Florida cannot get an unsecured loan over $6,000, Georgia cannot get an unsecured loan under $3,100, and Hawaii cannot get an unsecured loan under $1,600.

Other terms of your loan may vary by state, for example, in B. Texas, the limit for secured loans is $18,000. Therefore, we recommend that you check the terms before completing your registration.

Learn more about Oportun Personal Loans

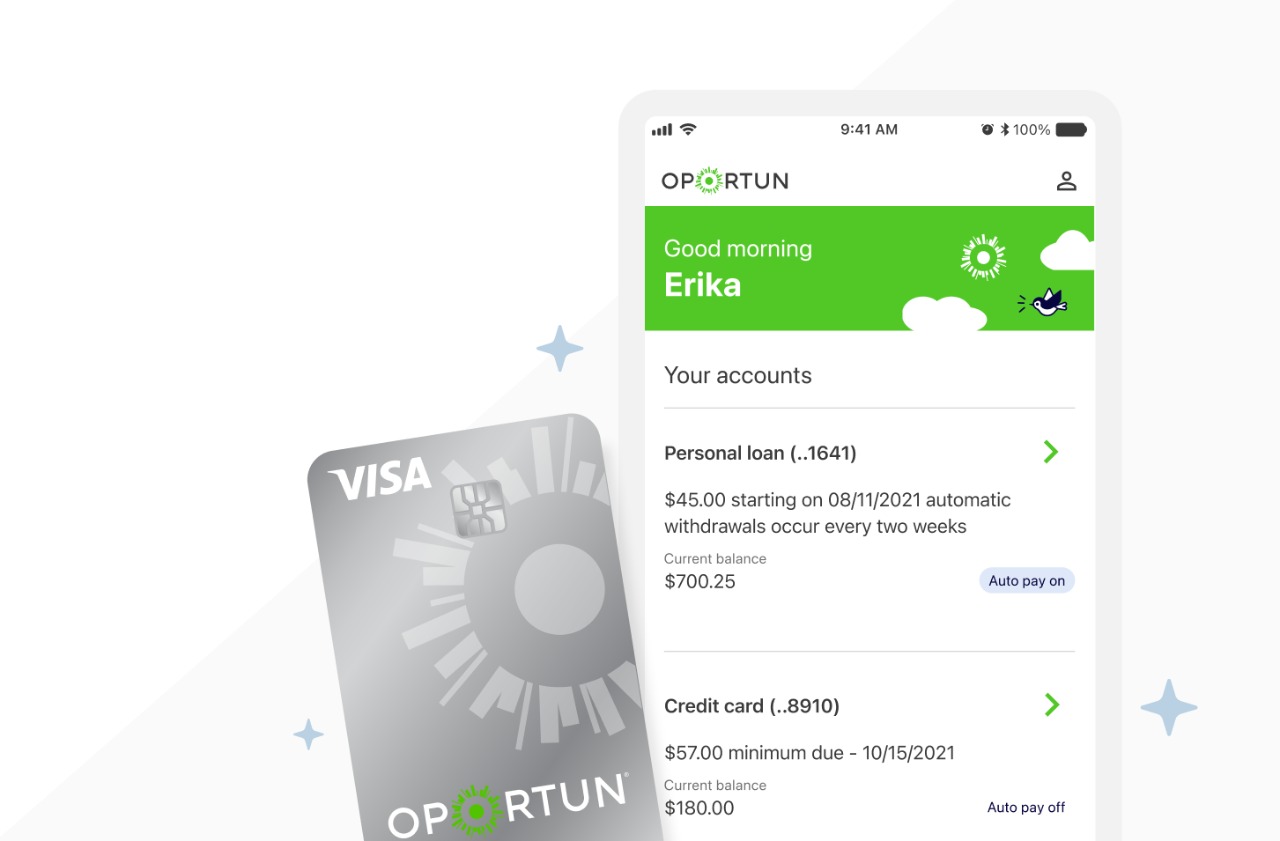

Oportun provides tools and articles to help you maintain a good credit history, save money, and be financially responsible.

And all credit scores are taken into account. So, if you don’t have good or bad credit, an Oportun loan might be a good option for you.

Also, consider that companies that offer loans also offer a variety of loan options to help those who need to reach their goals or cover unexpected expenses.

In addition to providing loans, Oportun also offers tools, educational resources, credit cards, and various types of investment options.

Advantages of Oportun Personal Loans

- FAST APPROVAL PROCESS

Oportun provides a swift approval process for personal loans, typically providing a decision quickly. This is ideal for borrowers who need funds urgently for emergencies or unexpected expenses. - NO CREDIT HISTORY REQUIRED

Oportun personal loans are accessible even to applicants with no credit history, making it easier for newcomers to credit to obtain financing without a prior track record. - COMPETITIVE INTEREST RATES

Oportun offers interest rates that are competitive within the market, which can result in lower overall cost of borrowing compared to other high-rate options. - FLEXIBLE LOAN TERMS

Borrowers can choose from a range of loan terms, which allows them to tailor their repayment schedule to fit their budget and financial circumstances. - BILINGUAL CUSTOMER SUPPORT

Oportun provides customer service in both English and Spanish, catering to a broader range of clients and ensuring that language barriers do not hinder the loan process. - SMALL LOAN AMOUNTS AVAILABLE

The lender offers loans starting from relatively small amounts, which is perfect for those who need a minor financial boost without the commitment to a large debt.

Disadvantages of Oportun Personal Loans

- LIMITED AVAILABILITY

Oportun’s services are not available in all states. This geographical restriction can limit access for some potential borrowers who do not reside in serviced areas. - POTENTIALLY HIGH APRS FOR SOME BORROWERS

While Oportun offers competitive rates, the APRs can be relatively high depending on the borrower’s credit profile and the specifics of the loan, potentially making it costlier for those with weaker credit scores. - SECURED LOAN REQUIREMENT FOR HIGHER AMOUNTS

Larger loan amounts may require collateral. This means borrowers need to secure the loan with assets, which could be at risk if repayments are not met. - FEES AND PENALTIES

There may be additional fees and penalties for late payments or insufficient funds, which can add to the total cost of the loan over time.

Simplified Guide to Applying for an Oportun Personal Loan

Securing an Oportun Personal Loan can be a straightforward and rewarding process. This article provides you with easy-to-follow steps to apply for a loan that suits your financial needs.

- Step 1: Assess Your Loan Needs Before you start, determine the loan amount you need. Oportun offers loans for various purposes, catering to different financial situations.

- Step 2: Verify Eligibility Criteria Check if you meet Oportun’s eligibility requirements. These criteria typically include credit history, income level, and employment status. Detailed information can be found on the Oportun website.

- Step 3: Gather Necessary Documentation Prepare essential documents, such as a valid ID, proof of income, and any other required paperwork. This preparation will streamline your application process.

- Step 4: Fill Out the Application Form Visit Oportun’s official website and navigate to their personal loan application page. Complete the application form carefully and accurately to avoid any delays.

- Step 5: Understand Loan Terms Once your application is reviewed, Oportun will present you with loan offers. Examine these offers closely, focusing on interest rates, repayment terms, and any applicable fees.

- Step 6: Accept the Loan Offer Select the most suitable loan offer and accept it. Ensure you fully understand all the terms and conditions before proceeding.

Conclusion

An Oportun Personal Loan can be a valuable tool for managing your finances. The company’s user-friendly application process, combined with a variety of loan options, makes it an appealing choice for many. Remember to consider your repayment capabilities carefully to maintain financial health.

5 SUVs With Some of the Lowest Estimated Monthly Payments in 2025 (Full Guide)

5 SUVs With Some of the Lowest Estimated Monthly Payments in 2025 (Full Guide)  Subaru Auto Loans

Subaru Auto Loans  CHASE AUTO LOAN — Smart Financing for Your Next Ride

CHASE AUTO LOAN — Smart Financing for Your Next Ride