People looking for a credit card with poor or no credit can apply for a secured card. These cards require a security deposit, which is often $100 to $200. Unfortunately, cashing out this deposit can be difficult for many people who don’t have the money to pay it.

Mission Lane

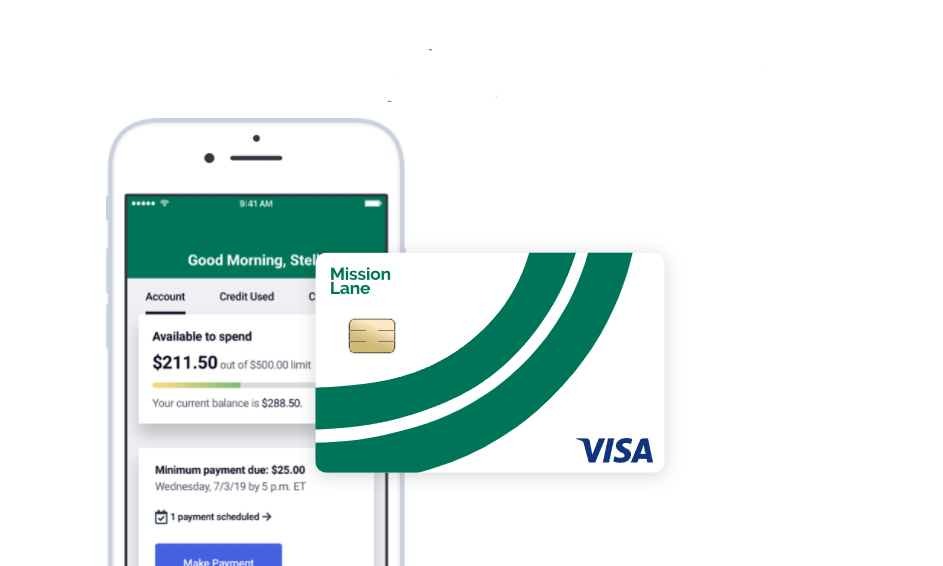

INSTANT CREDIT DECISION HIGHER CREDIT LINES OVER TIMEThe Mission Lane Visa card doesn’t require a security deposit when applicants start using their credit card. It’s ideal for anyone who wants to start building their credit history but can’t afford to spend money on a security deposit. The Mission Lane Visa card has a lower cost than most other unsecured cards for people with bad credit history.

Other card details

Mission Lane Visa’s easy application and no hidden fees make it superior to other unsecured credit cards.

Compared to other unsecured credit cards, Mission Lane provides the best tools for building credit quickly. There are no monthly fees or annual increases for using the card, and there are no maintenance or activation fees. Additionally, card members receive special offers from businesses in their area.

Building a credit history is easy with the Mission Lane Visa card. Every month, Mission Lane Visa reports to all three credit bureaus. Using the card responsibly will ensure an easy credit-building process.

The Mission Lane Visa was created to help people with little to no credit history build their credit. Even people with low FICO scores can qualify for one of these cards. Alternatively, people with fair or average credit may have an even better chance of being approved.

Learn more about Mission Lane Visa Credit Card

Before submitting a formal application, Mission Lane encourages people to use a pre-qualification tool on their website. Using this tool won’t affect your credit score and will give you a better idea of whether you’ll be approved.

The Mission Lane Visa promises instant approval decisions when applying. This saves you time and energy as you won’t have to wait weeks to see if your application was approved.

The Mission Lane Visa could be a good option for building credit for people with little money to spend each year.

Other Benefits of the Card

- Zero Fraud Liability: If your card is lost or stolen, you won’t be liable for any fraudulent transactions.

- Emergency Card Replacements: In case of lost or stolen cards, there are emergency cash advances and replacements available.

- Identity Theft Protection: Monitoring your account can prevent hacking and identity theft, as well as provide credit monitoring.

- Roadside dispatch: Pay-per-use emergency roadside assistance programs can be accessed through roadside dispatches.

Applying for a Mission Lane Visa Credit Card: A Step-by-Step Guide

Embarking on the journey to apply for a Mission Lane Visa Credit Card is a straightforward and rewarding process. This guide aims to assist you every step of the way, ensuring a smooth and understandable experience.

- Step 1: Research and Eligibility Before applying, familiarize yourself with the benefits and features of the Mission Lane Visa Credit Card. Understand its interest rates, fees, and rewards program. Ensure you meet the eligibility criteria, such as age and credit score requirements.

- Step 2: Gather Necessary Information Prepare the necessary documents. Typically, this includes your personal details (name, address, Social Security number), employment information, and financial data like annual income.

- Step 3: Visit Mission Lane’s Website Head to Mission Lane’s official website. Their user-friendly interface makes it easy to find the credit card application section. Look for clear tabs or buttons labeled “Apply Now” or “Credit Cards.”

- Step 4: Complete the Application Form Fill out the online application form with accuracy. Double-check your entries for any errors that might hinder your application process.

- Step 5: Submit and Await Response After reviewing your application, submit it. Mission Lane usually provides a prompt response, either instantly or within a few business days. Keep an eye on your email for their decision.

- Step 6: Next Steps after Approval If approved, you’ll receive further instructions on how to proceed, including signing any necessary agreements and receiving your card.

Conclusion

Applying for a Mission Lane Visa Credit Card is a seamless process. By following these steps and preparing accordingly, you can enhance your financial toolkit with this valuable credit card option. Remember, patience and attention to detail are key to a successful application.

BankAmericard® Credit Card for Students — A Solid Starting Point for Building Credit the Right Way

BankAmericard® Credit Card for Students — A Solid Starting Point for Building Credit the Right Way  Simplify Your Finances with the U.S. Bank Smartly™ Visa Signature® Card

Simplify Your Finances with the U.S. Bank Smartly™ Visa Signature® Card  U.S. Bank Shopper Cash Rewards® Visa Signature®

U.S. Bank Shopper Cash Rewards® Visa Signature®