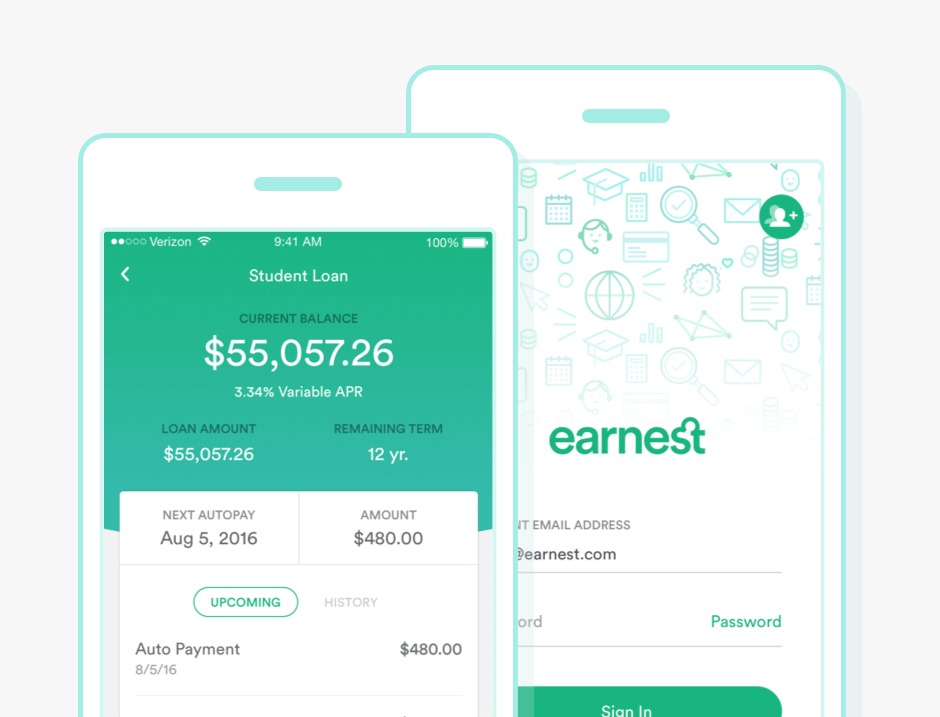

Earnest provides private and refinancing student loans with affordable interest rates, no fees, and a longer grace period for repayment than the industry standard. Additionally, borrowers have access to various choices for repayment, such as the opportunity to skip a payment1, choose their own due date, or create a customized payback schedule with a certain number of months.

You may quickly determine if you would qualify for its loans and what conditions you could be eligible for thanks to eligibility rules that are more transparent than those of other lenders and a prequalification tool.

Other details

Since it began providing these loans in 2015, Earnest has been a pioneer in student debt refinancing. In 2019, the business later added private student loans to its lineup of offerings. The business now provides a range of private student loans, including:

- Undergraduate

- Graduate

- MBA

- Medical

- Law

- Parent

Earnest provides loans to parents and students in almost all states, while residents of Kentucky and Nevada are not eligible for refinancing loans. Additionally, Nevada residents are not eligible for Earnest’s private student loans. Additionally, it provides personal loans and credit cards.

Learn more about Earnest Student Loans

Students in their first year of college are eligible to borrow a minimum of $1,000 up to the entire cost of tuition. You can pick a payback period from five to 15 years when you select and meet the requirements for your loan. Nevada residents are ineligible for private student loans from Earnest.

Earnest is distinctive in that you are not forced to select from a list of predetermined payback arrangements. The majority of private lenders provide strict repayment terms, such as five, ten, or fifteen years. With Earnest’s “precision pricing,” you may choose the precise number of months you’d want to pay back your loan depending on your chosen monthly payment.

Other Benefits of the Loan

- No cosigner is required: You may be qualified for a student loan depending on your credit history, income, and other characteristics, unlike with other student loan providers.

- Skip a payment: Earnest enables qualified borrowers of student loans and refinancing to omit one payment every 12 months. However, take in mind that doing so lengthens your payback period and counts against your forbearance allowance.

- Extended grace period: Eligible borrowers are permitted to postpone payments for up to nine months following graduation.

A Step-by-Step Guide to Applying for Earnest Student Loans

Navigating the world of student loans can be daunting, but Earnest Student Loans offers a streamlined, user-friendly process. This guide is designed to assist you step-by-step in applying for an Earnest Student Loan, ensuring a smooth and understandable journey towards financing your education.

- Step 1: Assess Your Eligibility Before diving into the application process, it’s crucial to assess your eligibility. Earnest Student Loans typically require a good credit score, a stable income, and enrollment in an accredited educational institution. Visit the Earnest website to review their specific eligibility criteria.

- Step 2: Gather Necessary Documents Prepare the necessary documentation, including proof of identity, income verification, and school enrollment details. Having these documents ready can expedite the application process.

- Step 3: Complete the Online Application Navigate to the Earnest Student Loans application page. The process is straightforward – fill in personal, financial, and educational information. Be thorough and accurate to avoid delays.

- Step 4: Review Loan Terms Once your application is processed, you’ll receive loan offers. Review these carefully, paying attention to interest rates, repayment terms, and any fees. This is a crucial step to ensure you understand your financial commitment.

- Step 5: Accept the Loan and Complete Verification After choosing the best loan option for you, accept the offer. Earnest may require additional verification steps – follow these promptly to finalize your loan.

Conclusion

Choosing the right student loan is a significant decision, and Earnest Student Loans offer a flexible, transparent option. Their application process is designed for ease and clarity, ensuring borrowers are well-informed every step of the way. With competitive rates and personalized repayment options, Earnest stands out as a reliable partner in financing your education. Remember, it’s important to borrow responsibly and understand the long-term implications of your financial decisions. With Earnest, you’re not just getting a loan; you’re investing in your future with a company that values your success.

5 SUVs With Some of the Lowest Estimated Monthly Payments in 2025 (Full Guide)

5 SUVs With Some of the Lowest Estimated Monthly Payments in 2025 (Full Guide)  Subaru Auto Loans

Subaru Auto Loans  CHASE AUTO LOAN — Smart Financing for Your Next Ride

CHASE AUTO LOAN — Smart Financing for Your Next Ride