While the Citi Diamond Preferred Card has slightly above-average fees, these fees are justified considering it is a zero-interest card with a long introductory APR period and 0% APR.

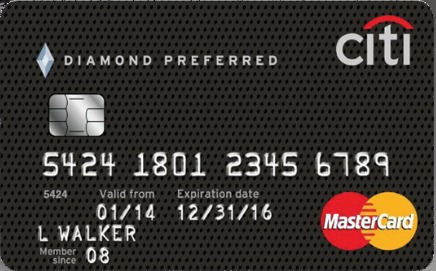

CITI® DIAMOND PREFERRED®

Mobile app $0 annual feeIn addition, the Citi Diamond Preferred Card does not charge an annual fee, which is at least less of a problem to worry about, even more so for those who have an interest in the card to consolidate debt.

Other card details

The Citi Diamond Preferred Card, compared to other cards, is still advantageous. The 0% APR for balance transfers for 21 months for example is not commonly found on other cards, which offer an average of 12 to 15 months.

To put it more bluntly, at the end of the day, what matters is being ready to pay off debts as quickly and efficiently as possible. And the Citi Diamond Preferred Card is the best solution to this problem, as its APR benefits, its absence of annual fees, and the fact that it is a zero-interest card make it a card that is at best rare find in today’s market.

Learn more about Citi Diamond Preferred Card

The biggest advantage of this card is its 21-month introductory offer, which means you pay no interest for the first 21 months of opening your account. In addition, your 0% APR is valid not only for new expenses but also for balance transfers. And let’s not forget about the absence of annual fees.

To apply for the Citi Diamond Preferred Card, a score of at least 670 to 739 is required, remembering that your score will affect your regular APR once the introductory period ends. A high credit score can make approval easier and can be a major factor in getting an APR at the lower end of the card range.

Other Benefits of the Card

- $0 liability protection: The Mastercard app can report unauthorized charges faster than traditional methods. If your account is charged without authorization, you will receive $0 liability protection from Mastercard. In addition, the card offers liability protection against unauthorized charges in-store, online, or over the phone.

- Citi Entertainment: When you pay with your Citi card, you can get special access to exclusive event tickets like sporting events, dining experiences, and more.

- EMV Chip Technology: Contactless Chip Payments.

- Citi Flex Loans: Borrow money from your Citi Card’s credit line at a fixed rate and repay it over a set term, with no additional fees, credit requests, or inquiries. This can be a useful tool if you need to pay in installments in the future.

- Citi Easy Deals: A collection of daily discounts and everyday shopping deals, including local deals from restaurants and retailers. Depending on how much you spend each year, you can also unlock promotions on gift cards, magazines, travel, merchandise, and more.

Learn how to apply

Applying for the Citi Diamond Preferred Card can be a straightforward and rewarding process. This guide will help you navigate the application steps with ease.

- Step 1: Research and Eligibility Start by visiting the official Citi website to research the Citi Diamond Preferred Card. Understand its features, benefits, APR, and credit requirements. Ensure you meet the eligibility criteria, typically including a good to excellent credit score.

- Step 2: Gather Necessary Information Prepare your personal and financial information. This includes your full name, address, Social Security number, annual income, and employment details. Having these at hand speeds up the application process.

- Step 3: Apply Online On the Citi website, locate the Citi Diamond Preferred Card application page. Fill in the required fields with accurate information. Be thorough and honest in your application to increase your chances of approval.

- Step 4: Wait for Approval After submission, Citi will review your application. This process can take a few minutes to a week. You’ll receive a response via email or mail.

- Step 5: Activate Your Card Once approved, your Citi Diamond Preferred Card will be mailed to you. Activate it following the provided instructions, and start enjoying its benefits.

Remember, applying for a credit card involves a credit check, which can affect your credit score. Always use credit responsibly to maintain or improve your credit rating.

BankAmericard® Credit Card for Students — A Solid Starting Point for Building Credit the Right Way

BankAmericard® Credit Card for Students — A Solid Starting Point for Building Credit the Right Way  Simplify Your Finances with the U.S. Bank Smartly™ Visa Signature® Card

Simplify Your Finances with the U.S. Bank Smartly™ Visa Signature® Card  U.S. Bank Shopper Cash Rewards® Visa Signature®

U.S. Bank Shopper Cash Rewards® Visa Signature®