Financing a vehicle can feel overwhelming, but with the right partner, the process becomes much simpler and more rewarding. Loan Ford Credite is designed to make owning or leasing a Ford more accessible for drivers across the country. By combining affordability, convenience, and customer-focused solutions, it transforms what could be a stressful step into a smooth experience.

Ford Credite

Shop With Confidence Estimate Your Monthly PaymentInstead of worrying about hidden charges or confusing agreements, customers gain access to transparent financing supported by one of the most respected names in the automotive industry. With flexible repayment options, competitive rates, and loyalty benefits, Ford Credit goes beyond financing—it provides peace of mind and long-term value.

Benefits of Loan Ford Credite

- Competitive Interest Rates – Customers can enjoy attractive APRs that make monthly payments more manageable.

- Flexible Terms – Borrowers can choose repayment schedules tailored to their financial goals, whether paying off quickly or spreading payments over time.

- Pre-Approval Confidence – By securing pre-approval, customers shop with a clear budget and stronger negotiating power.

- Loyalty Rewards – Ford often offers promotions and discounts to repeat customers, adding extra savings.

- Trusted Brand Reliability – Financing directly with Ford ensures confidence, backed by decades of automotive excellence.

Each of these advantages highlights how Loan Ford Credite adapts to different needs, from first-time buyers to loyal Ford enthusiasts.

Quality That Benefits the Consumer

Ford Credit is recognized for its commitment to transparency and customer satisfaction. Unlike some lenders, Loan Ford Credite prioritizes clarity, offering straightforward agreements with no hidden fees. This ensures that customers always know what to expect, creating a trustworthy financing experience.

Borrowers benefit not only from the financial aspects but also from Ford’s dedication to quality, making this loan an ideal choice for anyone seeking dependable support throughout their ownership journey.

Savings and Advantages

One of the strongest reasons to consider Loan Ford Credite is its ability to generate real financial savings. With lower interest rates and tailored repayment options, customers can reduce both their monthly payments and the total cost of ownership.

In addition, promotional offers and loyalty discounts help repeat Ford customers save even more over time. For families, first-time buyers, or businesses managing multiple vehicles, these financial benefits can make a significant difference.

Extra Value Through Benefits

Beyond affordability, Loan Ford Credite delivers added value that enhances the ownership experience. Loyalty programs often include exclusive upgrade offers, reduced down payments, or special lease rates. These extras make it easier for drivers to stay in newer Ford models while enjoying consistent savings.

By aligning financing with customer needs, Ford ensures borrowers receive more than just a loan—they gain a financial partner dedicated to helping them succeed.

Security and Peace of Mind

Purchasing a vehicle is a major commitment, and security is essential. Loan Ford Credite provides peace of mind through transparent agreements, stable interest rates, and the reliability of a trusted brand.

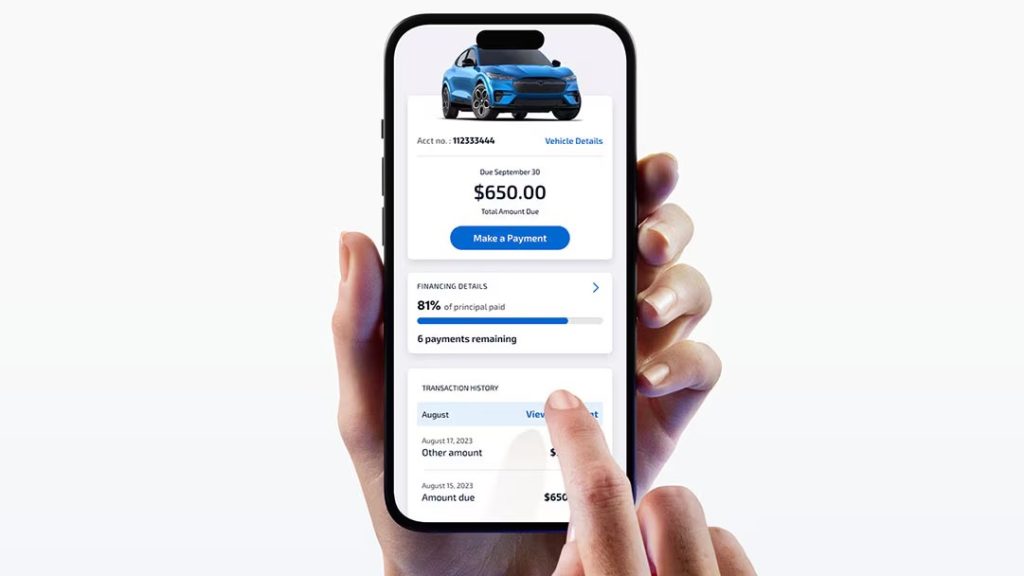

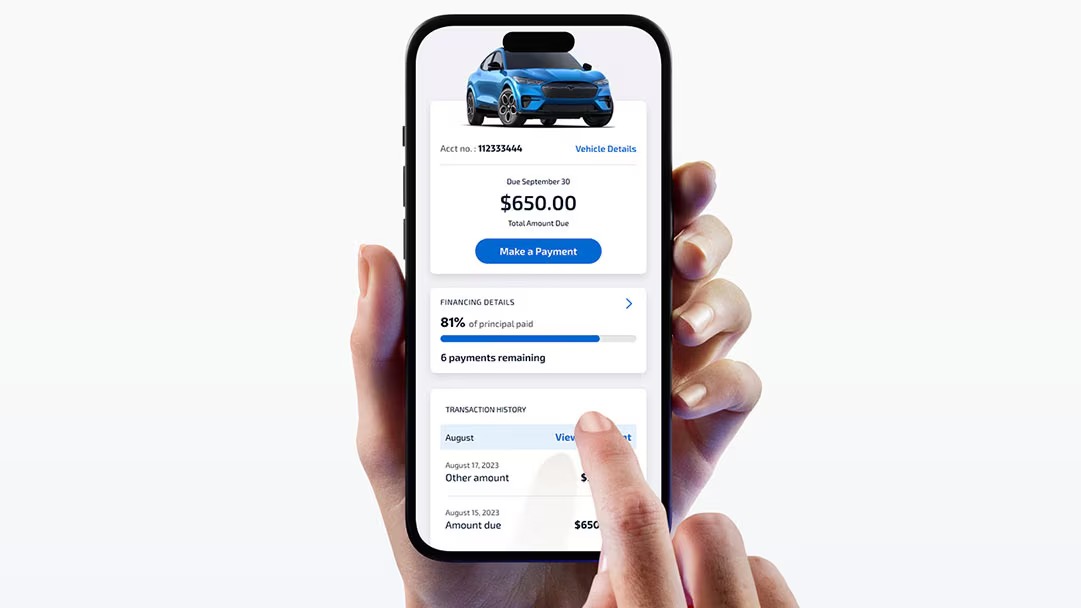

With online account management tools and responsive customer support, borrowers can stay in control of their financing at every step. This combination of safety and convenience ensures a stress-free ownership journey.

Eligibility Criteria

To qualify for Loan Ford Credite, applicants generally need to:

- Provide proof of income and stable employment history.

- Present valid identification and proof of residence.

- Meet Ford’s creditworthiness requirements based on credit score and financial profile.

These criteria ensure responsible lending while making financing accessible to a wide range of consumers.

Application Process

Applying for Loan Ford Credite is simple and designed to be user-friendly. The process typically follows these steps:

- Choose Your Ford Vehicle – Select a new or pre-owned Ford that fits your needs.

- Explore Financing Options – Review available loan and lease programs tailored to your budget.

- Submit an Application – Provide personal, financial, and employment details.

- Receive Pre-Approval – Ford Credit reviews your application and may grant pre-approval, giving you clarity before visiting a dealer.

- Finalize Terms – Once approved, review your loan terms, including APR, repayment schedule, and conditions.

- Sign the Agreement – Complete the contract digitally or in person for faster processing.

- Drive with Confidence – Take home your Ford knowing your financing plan is secure and transparent.

This straightforward process helps eliminate stress while making ownership more attainable.

Step-by-Step: How to Apply for a Loan Ford Credite

- Visit a Ford Dealership or the Ford Credit Website.

- Select Your Loan or Lease Option.

- Fill Out the Application Form.

- Submit Required Documents (proof of income, ID, insurance).

- Review Your Offer, Including Rates and Terms.

- Accept and Sign the Agreement.

- Finalize with the Dealer and Drive Away in Your Ford.

5 SUVs With Some of the Lowest Estimated Monthly Payments in 2025 (Full Guide)

5 SUVs With Some of the Lowest Estimated Monthly Payments in 2025 (Full Guide)  Subaru Auto Loans

Subaru Auto Loans  CHASE AUTO LOAN — Smart Financing for Your Next Ride

CHASE AUTO LOAN — Smart Financing for Your Next Ride