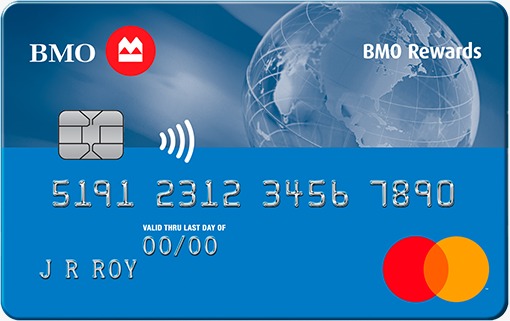

BMO Rewards® Mastercard®

Rewards point $0 annual feeThe BMO Rewards MasterCard, like the majority of no-annual-fee cards, has a lesser welcome bonus, a lower earn rate, and fewer insurance benefits.

However, it just has a $15k minimum income requirement, it’s recognized at Costco, and you’re able to add more cardholders to your account to make more money.

Advantages of BMO Rewards® Mastercard®

- EARN POINTS ON EVERYDAY PURCHASES

For every dollar spent using the BMO Rewards® Mastercard®, cardholders accumulate points that can be redeemed for travel, merchandise, gift cards, or financial rewards. - NO ANNUAL FEE

This card offers the benefit of no annual fee, making it an economical choice for users who want to earn rewards without additional costs. - WELCOME BONUS

New cardholders can take advantage of a welcome bonus, which boosts the initial value of the card by offering extra rewards points after the first few purchases. - FLEXIBLE REDEMPTION OPTIONS

Points earned can be used in a variety of ways, from booking flights and hotels directly through the BMO Rewards program to purchasing electronics and other goods. - EXTENDED WARRANTY

Purchases made with the card often come with an extended warranty, which adds additional protection on top of the manufacturer’s warranty. - PURCHASE PROTECTION

This feature provides added security by offering short-term insurance on new purchases against theft or damage.

Disadvantages of BMO Rewards® Mastercard®

- HIGHER INTEREST RATES

The interest rates on balances can be relatively high, which might discourage cardholders who tend to carry a balance from month to month. - LIMITED HIGH-END REWARDS

Compared to premium credit cards, the BMO Rewards® Mastercard® might offer fewer luxury travel benefits or exclusive rewards opportunities. - FOREIGN TRANSACTION FEES

There is a charge for transactions made in foreign currencies, which could add up for those who travel internationally or shop from foreign online retailers. - CREDIT SCORE IMPACT

Applying for this card requires a hard pull on your credit report, which could temporarily lower your credit score.

Why Apply for the BMO Rewards® Mastercard®?

If you’re searching for a credit card that aligns seamlessly with everyday spending and rewards you for it, the BMO Rewards® Mastercard® is an excellent choice. With no annual fee to worry about, every purchase brings you closer to fabulous rewards without the burden of additional costs.

The flexibility of the rewards system lets you dictate how you use your points, whether it’s for a quick weekend getaway, the latest tech gadgets, or simply applying points to reduce your credit card balance. The added financial security features such as purchase protection and extended warranties provide peace of mind with every transaction.

Whether you’re dining out, traveling, or buying online, this card works hard to enrich your purchasing experiences. Apply today to start enjoying these benefits and make every dollar spent count towards something rewarding. Don’t miss out on the chance to make your expenses work for you!

Unveiling the Benefits of American Express Cobalt Card

Unveiling the Benefits of American Express Cobalt Card  Unlock Exclusive Benefits with Tangerine World Mastercard

Unlock Exclusive Benefits with Tangerine World Mastercard  American Express Aeroplan Reserve Card

American Express Aeroplan Reserve Card