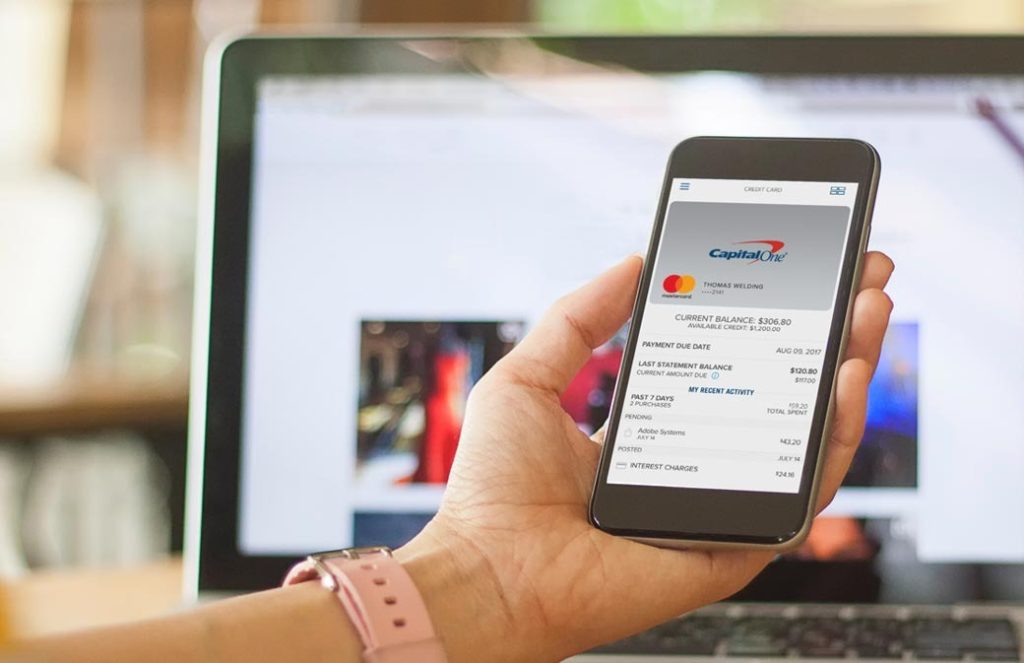

This is the credit card with cash back Capital One gives to Canadian customers. There is no annual fee for this credit card, and the annual percentage rate on purchases, debt transfers, and cash advances is 19.8%. Additionally, cardholders can add more authorized users without paying an annual cost.

Capital One Aspire Cash Platinum

Cash back No Annual FeeOn every dollar spent with their Capital One Aspire Cash Platinum Mastercard, cardholders receive 1% cash back. Then, cardholders can either get their cash back as a statement credit or a check. Furthermore, Capital One cash back benefits never expire, allowing users to receive any amount of cash back at any time.

Other card details

The Aspire Cash Platinum Mastercard from Capital One provides cardholders with a straightforward and practical option to receive cash back on purchases. Cardholders can receive far more cash back depending on the transactions of individuals they support thanks to the option of adding other authorized users without incurring a yearly charge. Finally, Canadians looking for a cashback card without other advantages that they would not use would find this card to be a great option because Capital One’s mobile app makes it simple to redeem cash back for a statement credit in as few as two clicks.

Purchase protection, extended warranties, several practical travel insurance options, and zero-liability fraud protection are additional perks.

Learn more about Capital One Aspire Cash Platinum

Since Capital One Canada is not a large bank, it should not be compared to them. Neither regular bank accounts nor investing services are provided. Many of the credit card options offered by the Big Five banks are also available from Capital One Canada if you’re seeking one.

Reviews of Capital One’s Aspire Cash Platinum Mastercard are generally favorable. Based on almost 400 evaluations, the card has an overall customer rating of 4.3 out of 5 on the Mastercard website. The online experience, customer service, and account features of the Aspire Cash Platinum Mastercard are excellent.

Other Benefits of the Card

- Price Protection Service

- Common Carrier Travel Accident Insurance

- Baggage Delay

- Travel Assistance

How to Apply Capital One Aspire Cash Platinum MasterCard Credit Card?

When considering credit card options, the Capital One Aspire Cash Platinum Credit Card stands out for its accessibility and rewards. This guide provides an easy-to-follow approach to applying for this card.

- Understanding the Card’s Benefits: The Capital One Aspire Cash Platinum offers cashback rewards, making it a practical choice for everyday spending. Research its features and compare with other options to ensure it aligns with your financial goals.

- Eligibility Criteria: Check the card’s eligibility requirements, including credit score and income level, to ensure you qualify.

- Application Process: Visit the Capital One website and navigate to the Aspire Cash Platinum Credit Card section. The online application is straightforward, requiring personal and financial information. Be thorough and honest in your responses.

- Awaiting Approval: After submission, you will typically receive a response quickly. If approved, you’ll be informed about your credit limit and other details.

- Responsible Usage: Once you receive your card, remember to use it responsibly. Regular payments and sensible spending will help build your credit score.

By following these steps, you can easily apply for the Capital One Aspire Cash Platinum Credit Card and start enjoying its benefits.

Discover Everyday Flexibility with the U.S. Bank Split™ World Mastercard®

Discover Everyday Flexibility with the U.S. Bank Split™ World Mastercard®  Unveiling the Benefits of American Express Cobalt Card

Unveiling the Benefits of American Express Cobalt Card  Unlock Exclusive Benefits with Tangerine World Mastercard

Unlock Exclusive Benefits with Tangerine World Mastercard