One of Canada’s first financial firms, BMO was established in 1817. BMO, which has its headquarters in Toronto, employs approximately 46,000 people and services and over 12 million clients nationwide.

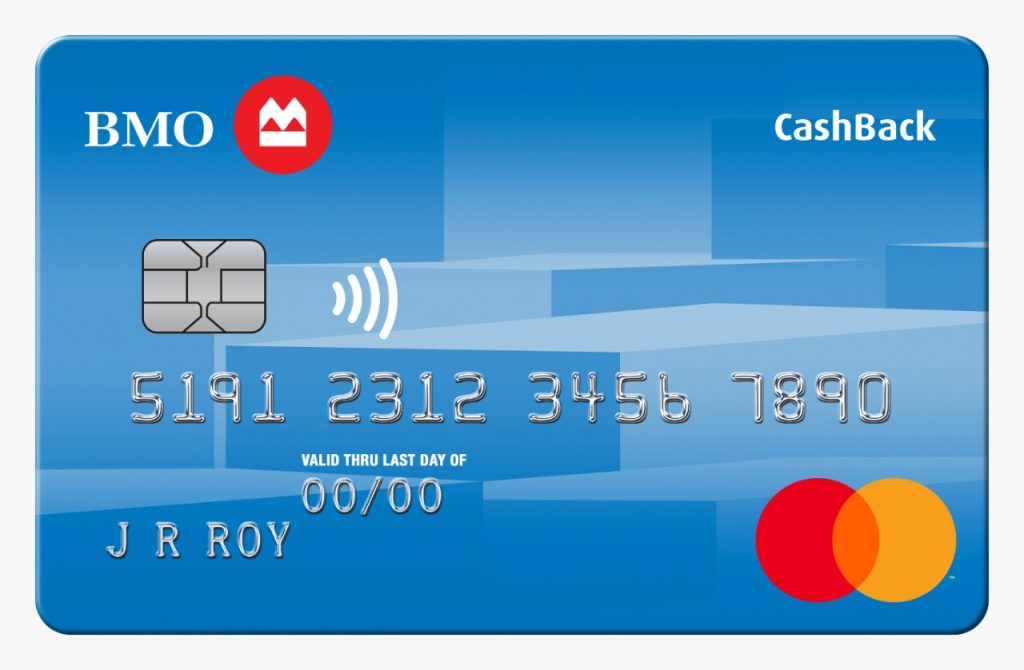

BMO Cashback

1% cash back $0 annual feeThe BMO Cashback Mastercard is one of the bank’s most well-liked offerings. The Cashback Mastercard is a rewarding credit card, so every transaction you make will earn you points.

Other card details

Because it provides students with competitive cash back when they purchase for necessities, we think the Student BMO cashback Mastercard is the top student credit card in Canada. For all other purchases, regardless of type, students receive 0.5% cash back. They also receive 3% money back on groceries, 1% money back on recurring bills (including mobile phone plans and streaming services), and 1% money back on all other payments. For the food and billing spending categories, there are monthly budget limitations of $500 every billing cycle; after that, students will only be paid the basic rate of 0.5%.

This card’s reward system makes it simple to both earn and redeem points. With the Student BMO cashback Mastercard, you may get your cash back at any time for as little as $1, in contrast to certain other cash back cards. This is a huge benefit for students who are on a tight budget since they can get their cash back when they truly need it, rather than needing to wait till their closing statement.

Learn more about BMO Cashback Mastercard Credit Card

The Student BMO Cashback Mastercard makes it simple and flexible to redeem your cash back benefits, which is a terrific benefit for students who are watching every dollar. You don’t have to wait until a specific period of time to use your cash back, in contrast to several other credit card schemes. If you’ve received at least $1 in cash back, you can claim whenever you choose. You may also start with a $25 redemption and set up monthly payments if you’d like. Your cash back can also be applied to the credit card statement or put into a BMO checking, savings, or investment account.

Given that most other cards only permit you to collect the cash once per year, this is amongst the most versatile cash back redeeming plans.

Other Benefits of the Card

- Additional warranty coverage and purchasing insurance

- At specific National Car Rental and Alamo Car Rental locations, save up to 25% on rentals

- Save 15% on Cirque Du Soleil performances that are on tour in Canada and 20% on shows that are in resident there

- No extra charge for an additional cardholder

How to apply this credit card?

Applying for the BMO Cashback Mastercard is a straightforward process that can be completed with ease. This guide will walk you through the necessary steps, ensuring a smooth experience.

- Step 1: Research and Eligibility

Before applying, research the features and benefits of the BMO Cashback Mastercard. Ensure you meet the eligibility criteria, typically including age and income requirements. - Step 2: Gather Required Information

Prepare necessary documents such as identification, proof of income, and residential details. This preparation streamlines the application process. - Step 3: Online Application

Visit the BMO website and navigate to the Cashback Mastercard section. Click on the ‘Apply Now’ button. Fill in the application form with accurate information. Double-check for errors to avoid delays. - Step 4: Application Review and Approval

Once submitted, BMO will review your application. This may involve a credit check. Upon approval, you’ll receive your BMO Cashback Mastercard, ready for activation and use.

Conclusion

Applying for the BMO Cashback Mastercard is a user-friendly process. By following these steps, you can efficiently secure a card that offers valuable cashback rewards, enhancing your spending power.

Discover Everyday Flexibility with the U.S. Bank Split™ World Mastercard®

Discover Everyday Flexibility with the U.S. Bank Split™ World Mastercard®  Unveiling the Benefits of American Express Cobalt Card

Unveiling the Benefits of American Express Cobalt Card  Unlock Exclusive Benefits with Tangerine World Mastercard

Unlock Exclusive Benefits with Tangerine World Mastercard