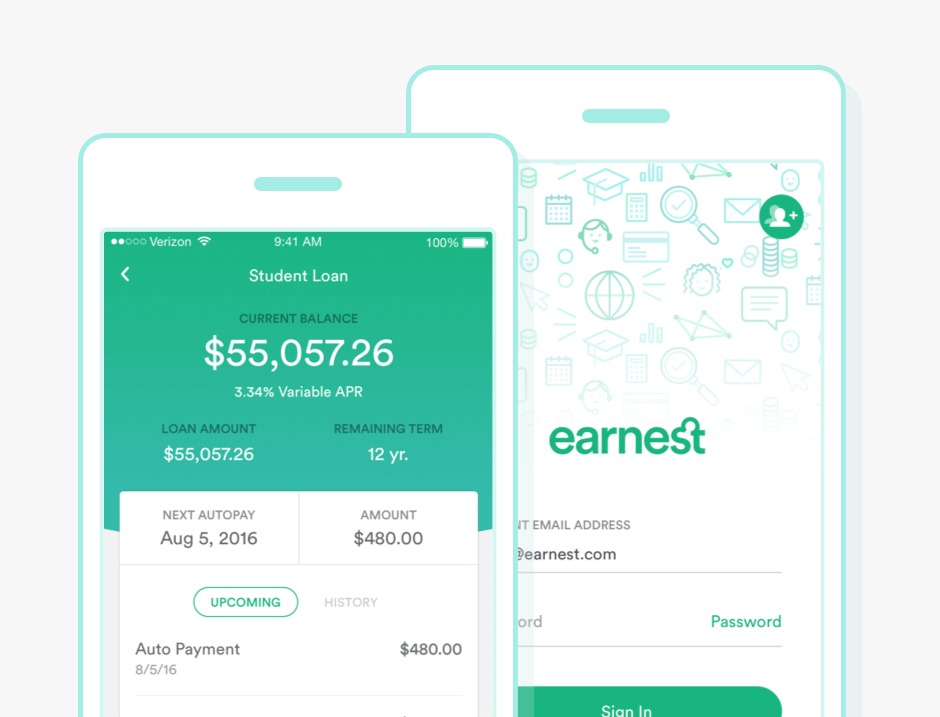

Online lender Earnest provides personal loans, student loan refinancing, and private student loans. For debtors who wish to modify their repayment plan in order to pay off debt quickly, its refinancing loan is the ideal option.

Borrowers who desire flexible repayment terms might choose its private student loan.

Some of its benefits are:

- $0 Prepayment penalties

- $0 Late fees

- $0 Origination fees

- Grace period of nine months

- Loans for college students, graduates, parents, and professionals

- Flexible loan terms and payments.

- Every 12 months, there is an option to skip one payment.

- Without a rigorous credit check, you can determine your eligibility and rate.

Earnest allows to search loan offers from several of the major lenders in one spot to save time. Apply now and start enjoying it!

Earnest Student Loans: A Smart Choice for Students

When it comes to financing your education, choosing the right student loan can make all the difference. Earnest Student Loans stand out as a top option for students seeking flexibility and competitive rates. With a focus on personalized loan options, Earnest offers both private student loans and refinancing solutions tailored to meet diverse financial needs.

One of the key features of Earnest Student Loans is the customizable repayment plans. Borrowers can choose between fixed and variable interest rates, and the loan terms can be adjusted from 5 to 20 years. This flexibility allows students to create a repayment plan that fits their financial situation, helping to manage monthly payments effectively.

Another standout aspect is the no-fee policy. Earnest does not charge any origination, prepayment, or late fees, which can significantly reduce the overall cost of the loan. Additionally, Earnest offers a unique “skip a payment” feature once a year, giving borrowers more control over their finances during unexpected circumstances.

For students looking to refinance their existing student loans, Earnest provides a seamless process with the potential to lower monthly payments or interest rates. Borrowers with good credit and steady income can benefit from the competitive rates, often resulting in substantial savings over the life of the loan.

Moreover, Earnest takes a holistic approach to evaluating loan applicants. Instead of focusing solely on credit scores, they consider factors like savings, earning potential, and financial habits. This approach can be particularly beneficial for students or recent graduates who may not have an extensive credit history.

In conclusion, Earnest Student Loans offer a blend of flexibility, affordability, and borrower-friendly terms. Whether you’re seeking a private loan for your studies or looking to refinance existing debt, Earnest provides a smart, student-centered solution.

Next Day Personal Loan

Next Day Personal Loan  Splash Financial Student Loan Program

Splash Financial Student Loan Program  Splash Financial Student Loan Program

Splash Financial Student Loan Program