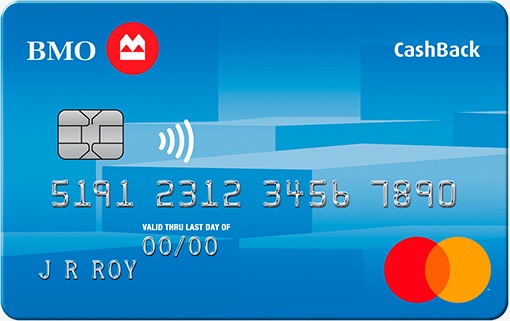

Navigating the world of credit cards can be daunting, especially for students who are new to managing their finances. The Student BMO CashBack Mastercard, designed specifically for students in Canada, offers a range of benefits tailored to meet the needs of young adults. This article will explore the features, advantages, and disadvantages of this credit card, providing all the essential information you need to decide if it’s the right fit for you.

Understanding the ins and outs of credit cards can be a valuable lesson in financial literacy. The Student BMO CashBack Mastercard not only provides a practical tool for managing expenses but also offers rewards and benefits that can make student life a bit easier. Let’s dive into what this card has to offer and see if it matches your financial goals.

Benefits of the Students – BMO CashBack® Mastercard®

- Cash Back on Every Purchase: Earn cash back on every dollar spent, making your everyday purchases more rewarding.

- No Annual Fee: This card comes with no annual fee, which is perfect for students looking to save money.

- Extended Warranty and Purchase Protection: Enjoy added security on your purchases with extended warranty and purchase protection.

- Access to Exclusive Offers: Get access to special promotions and discounts through the Mastercard network.

- Zero Liability Protection: You won’t be held responsible for unauthorized transactions, providing peace of mind.

- Flexible Payment Options: Manage your payments with flexibility, ensuring you can keep up with your financial commitments.

Why You Should Consider the Students – BMO CashBack® Mastercard®*

Choosing the right credit card as a student is crucial for managing your finances effectively. The Students – BMO CashBack® Mastercard®* offers a range of features designed to make your financial journey smoother and more rewarding. From no annual fee to generous cash back on everyday purchases, this card is crafted to meet the unique needs of students.

With this card, you can earn cash back on every purchase, which can be a significant advantage as you manage your budget. The initial high cashback rate for the first three months is an excellent way to maximize your savings on textbooks, supplies, and other essentials. Additionally, the extended warranty and purchase protection provide an extra layer of security for your purchases, ensuring you get the most value out of your money.

The zero liability protection is particularly important for students who are new to credit cards, as it safeguards against unauthorized transactions. Furthermore, access to exclusive offers and promotions can help you save even more on your everyday spending.

Unveiling the Benefits of American Express Cobalt Card

Unveiling the Benefits of American Express Cobalt Card  Unlock Exclusive Benefits with Tangerine World Mastercard

Unlock Exclusive Benefits with Tangerine World Mastercard  American Express Aeroplan Reserve Card

American Express Aeroplan Reserve Card