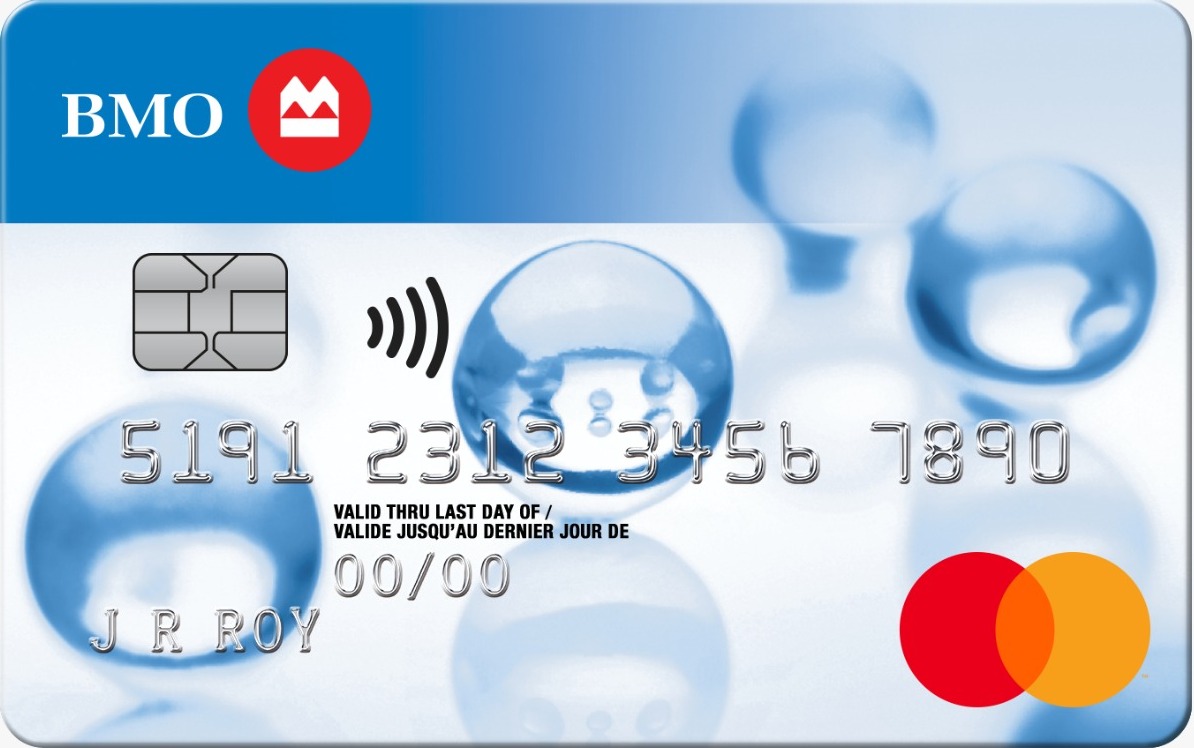

BMO Preferred Rate Mastercard

Our lowest interest rate Enjoy extended warranty and purchase protection.What makes this credit card so unique? There is a choice to be made when it comes to low-interest credit cards. Typically, you have to give up incentives and other perks that come included on most cards in order to save cash on interest fees.

The BMO Preferred Rate Mastercard is a mythical figure that offers you a fantastic rate while retaining the features you adore. Although you won’t receive cash back or other rewards, you will nonetheless save money in a variety of ways.

ADVANTAGES OF BMO PREFERRED RATE MASTERCARD

- LOW INTEREST RATE

The BMO Preferred Rate Mastercard offers a competitively low interest rate on purchases. This feature can be particularly beneficial for those who occasionally carry a balance, as it helps to minimize interest charges over time. - BALANCE TRANSFER OFFER

New cardholders can benefit from a special introductory offer on balance transfers. This includes a reduced interest rate for a set period, allowing users to manage existing debt more affordably and efficiently. - NO ANNUAL FEE

Unlike many other credit cards, the BMO Preferred Rate Mastercard does not charge an annual fee. This can add up to significant savings over time, making it an excellent choice for cost-conscious consumers. - PURCHASE PROTECTION

The card includes purchase protection that covers new items bought with the card against theft or damage. This feature provides peace of mind and financial protection for your new purchases. - EXTENDED WARRANTY

This credit card automatically extends the manufacturer’s warranty on purchases, which can help save money on potential repair or replacement costs. - FRAUD PROTECTION

Cardholders enjoy enhanced security features, including zero liability for unauthorized transactions, which safeguards against fraudulent charges and offers greater peace of mind.

DISADVANTAGES OF BMO PREFERRED RATE MASTERCARD

- FOREIGN TRANSACTION FEES

There is a charge for transactions made in a foreign currency, which could be a drawback for frequent international travelers or those who make online purchases from foreign merchants. - LIMITED REWARDS

Unlike some other credit cards, the BMO Preferred Rate Mastercard does not offer a points or rewards program. This could be a disadvantage for those who like to earn rewards on their spending. - CREDIT REQUIREMENT

Approval for this card typically requires a good to excellent credit score. This might limit accessibility for individuals with lower or developing credit histories. - MINIMAL PERKS

The card offers fewer perks and benefits compared to other cards with similar fees. For those seeking luxury travel benefits or extensive cash-back rewards, this might not be the best fit.

WHY APPLY FOR THE BMO PREFERRED RATE MASTERCARD?

If you’re seeking a straightforward, economical credit solution, the BMO Preferred Rate Mastercard is worth your consideration. Ideal for those who prefer simplicity over complex rewards systems, this card keeps it plain yet powerful with its primary focus on saving money.

Whether you’re planning to consolidate debt with a balance transfer or looking for a cost-effective way to manage your everyday spending, this card stands out. Its no-annual-fee feature combined with the low-interest rate makes it an attractive option for budget-savvy individuals.

Moreover, the added layer of security through robust fraud protection measures ensures that your financial details remain secure. Apply today and experience the blend of simplicity, savings, and security with the BMO Preferred Rate Mastercard—a smart choice for smart spenders.

Unveiling the Benefits of American Express Cobalt Card

Unveiling the Benefits of American Express Cobalt Card  Unlock Exclusive Benefits with Tangerine World Mastercard

Unlock Exclusive Benefits with Tangerine World Mastercard  American Express Aeroplan Reserve Card

American Express Aeroplan Reserve Card